Frugal food shopping - local market greengrocers

By Value hunter on Mar 2, 2014 | In In real life, Common sense, In the home, Thrifty shopping, Frugal victories | Send feedback »

A visit to my local market greengrocer, every Saturday morning offers a fantastic frugal way of keeping food costs down and allows my family to eat "fresh" every week.

I flatly refuse to buy fruit and veg from a supermarket, have done for around 7 years now.

Saves time - the convenience claims of supermarkets are nonsense.

I can shop far quicker around my local market, for most of my shopping, in half the time it takes to trawl around a supermarket.

Fresher produce - Market greengrocers have less storage space, little access to refridgeration, so the produce they sell moves quickly from wholesaler to business to me.

No "up to a year" shelf life for their fruit and vegetables, as is the case with supermarkets, so it is rare that their produce goes off and starts to turn within days of putting it in the fruit bowl/veg rack.

Onions are a great example, my local market greengrocer's "English onions" can last up to a month and still be fit for eating, without any refridgeration.

Better quality produce - an apple today is not the same as apples sold years ago, before supermarket dominance of our shopping bills.

Why do you think many supermarket apples (for example) are grown as far away as China?

Countries outside of the EU do not have our strict food regulations, so anything can be added to the produce in it's growing stage, to increase size, texture, appearance (gas waxes), etc.

Shopping at local markets doesn't eliminate this process, but you are less likely to come across it and more local produce is more often available.

More seasonal produce - do you know the season for raspberries off the top of your head? (Raspberries are an early summer fruit traditionally - June to early August - there are some varieties that are late summer - August to late October)

Supermarkets sell raspberries almost all year round, for really high prices.

Saving me money - I've saved the best for last.

The whole point of being frugal, saving your hard earned money.

Potatoes, a complete no brainer and on it's own, worth shopping at my local market greengrocers.

A quick look at Asda's website, shows me the per kilogram price of what they charge.

I am buying king edward potatoes at the moment and can tell you I am not paying more than 40p per kilogram for them.

Asda's maris pipers (a water holding, budget potato), are currently 90p per kilogram!

I can buy my king edwards in half or a full sack amounts from the market greengrocers. (£10 divided by 25kg = 40p per kilogram)

They are fresher, do not turn for weeks, they stay the same price and don't fluctuate week to week, I only have to buy them once every month, so I am not repeat visiting a supermarket, less temptation to buy other things, saving yet more money.

If I bought 2kg of maris pipers from the supermarket each week, compared to how I buy my king edwards or similar from my market greengrocers, just look at the saving;

Supermarket - 104kg per year at 90p per kg = £93.60

Market greengrocers - 104kg per year at 40p per kg = £41.60

A saving on one product line alone, of £52.

Factor in, that there are just 12 visits to my market greengrocer needed to get them, against 26 visits to the supermarket (buying a 2kg bag each week) a reduction in carrying, buying, temptation of buying other things and saving money.

How can this not be better for you?

Flexibility - how many times have you had some fruit or veg from a supermarket and it's gone off or been damaged so it's beyond edible, told them a week later on your return and been given some more for free?

Never? Once?

Market greengrocer's business depends on local custom.

They are more felixible, more reliable sellers of fruit and vegetables than any supermarket can come anywhere close to.

Better service - I know most of the staff and the owners of my local market greengrocer by name and they know mine.

What's your supermarket fruit and vegetable department, shelf stacker's name?

How long have they been in the business of fruit and veg?

Do they know recipes? Do they know what's in season? Do they know where their produce comes from, how it got to the shelf, how old it is? Do they even care?

I TRUST them.

Can you taste produce from a supermarket?

Profits, waste, moral arguments - I use a local market greengrocer business, there is less waste produce because it doesn't go off anywhere near as fast as supermarket's produce.

Less packaging, less distance from grower to shelf (less CO2) so better for the environment. Most produce is grown in the UK and what isn't is clearly marked. None of the supermarket repackaging in the UK so it can be labelled as from the UK nonsense.

I understand that my greengrocer is a business, but where do their profits go?

Supermarket profits go towards a total profit line that disappears abroad, into money markets, shareholders etc.

My local market greengrocers live around the area I live, they buy products and services in the local economy. This is better for me in the long run as it helps to keep other local businesses open and trading, which increases local competition which in turn, keeps prices of other goods and services down and gives me more choice.

My greengrocers pays the set levels of tax, they don't move or exploite tax loopholes, so services benefit also.

Bonus savings - I've saved this one until last as it's a cracking way to be frugal!

Look for a market greengrocer that supplies restaurants, bakers, hotels etc.

They do not only sell fruit and vegetables!

Ask them about eggs.

When was the last time you paid 88p for half a dozen medium to large eggs?

For the last year I have been paying £3.50 for a tray of 24 (2 dozen) medium to large eggs from my market greengrocers.

They buy trays of eggs direct from the auctions and savings are passed on to their customers.

I hope I have given you enough reasons to shop at your local market greengrocers, I do, my family and my local community benefits from it.

So why don't you give it a try?

How can you afford not to?

Proof that new boiler "bill savings" were false all along!

By Value hunter on Dec 29, 2013 | In In real life, In the home, Bad business, Frugal wars, Rip off Britain | Send feedback »

Zac Goldsmith MP and Greg Barker MP, the current energy and climate change minister for government has, while promoting the government "green deal" program, let the cat out of the bag as regards the actual bill savings per customer, for changing their boiler from a G rated boiler to an A rated "energy efficient" boiler.

Our household believed the hype and promotion from the Energy Saving Trust, which said years ago and continues to say today, that replacing our G rated boiler (62% efficiency) with an A rated boiler (94% efficiency) would save us £300 (now they say £310) pounds per year on our fuel bills.

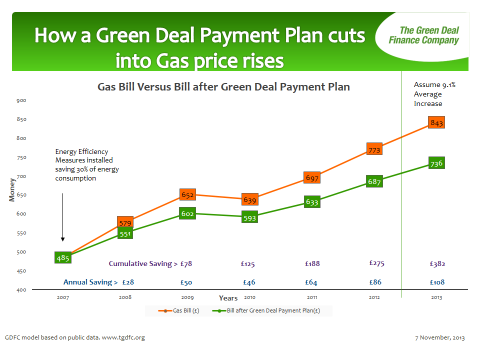

Their twitter post (Zac Goldsmith's twitter post) included a graphic, showing average actual bill savings per year from 2007, based upon 30% less energy consumption from energy efficiency measures being fitted.

In our home we replaced a G rated boiler (62% efficiency) with an A rated boiler (94% efficiency)

We fitted a log burner which replaces the central heating being used.

We fitted an extra layer of loft insulation.

We fitted full double glazing throughout the house including doors.

We fitted an extra layer of rendering outside.

We fitted more cavity wall insulation.

We bought A++ rated appliances, fridge, freezer and washing machine.

We also had one less adult in the home, less use of hot water, heating, etc.

According to our two energy provider's "energy saving departments" we had installed far more energy efficiency measures than the average household, indeed they both went further, stating that we had exceeded measures that energy companies would recommend.

Well in excess of the 30% fuel efficiency savings quoted in the official figures for the green deal.

In reality, our bills have fallen not one jot.

In terms of metered units used, we actually use more now than we did before the almost £7000 worth of energy efficiency measures were fitted.

I've had endless frugal ways comments and emails via the website, stating something must be wrong for this to be the case.

I've been told I don't understand energy bills, how they work and are calculated, it's been suggested that we use more now because we leave jumpers off and have the heating on longer (even though it's clear we do not, we even have an alternative source of heating instead of using central heating, but some people simply don't listen!)

The Energy Saving Trust publish estimated figures based on criteria that our home matches, it has even been suggested that the Energy Saving Trust's figures are based on different criteria from the criteria they published and claim is the basis of their own figures! When I asked where this magical new criteria was for the public to view, the person posting did not reply.

Our energy companies have insisted that we should wait until the following year and "it will even itself out" - which it hasn't!

Our energy companies even stopped publishing metered units used on it's statements!

I've asked questions on twitter of the Energy Saving Trust, Greg Barker MP, Caroline Flint MP, EnergyUK and independant twitter accounts, not one person has answered.

I've been met with a wall of silence.

Now with the graphic published above, the truth has finally come out and shown that all the energy efficiency hype they spouted then and continue to spout today is a con trick to increase business within the industry.

According to the "Green deal" actual bill saving figures, savings figures claimed by the Energy Saving Trust and successive government's schemes have been way off!

Official figures show:

2007 - Fitted energy efficient measures reducing consumption by 30%

2008 - Actual bill saving was just £28 (EST claim £300 per year for new boiler alone!)

2009 - Actual bill saving was just £50 (EST claim £300 per year)

2010 - Actual bill saving was just £46 (EST claim £300 per year)

2011 - Actual bill saving was just £64 (EST claim £300 per year)

2012 - Actual bill saving was just £86 (EST claim £310 per year)

Energy Saving Trust total for boiler change - £1510 in "estimated" bill savings.

Actual total for 30% reduction in energy consumption over the same period - was just £274.

When a new boiler costs £2300 (on average) and has a life of 12 years, the figures look even worse.

According to the Energy Saving Trust's figures, a new boiler would take 7.6 years to pay for itself (£2300 fitting cost divided by £300 bill saving per year)

According to figures released by MPs and the Green deal company, based on actual savings, if the highest yearly bill saving so far was typical every year, a new boiler would take over 26 years to pay for itself (£2300 fitting cost divided by £86 actual bill saving per year).

Factor in double glazing, extra render, more insulation (both loft and wall) and a non gas heating system, this shows what a marketing con trick this all is.

This explains why Zac Goldsmith MP, Greg Barker MP (minister for energy), the Energy Saving trust and several independant twitter users, have absolutely nothing to say when questioned on the figures.

They all claimed I was wrong and "misunderstood" how it all worked, it would appear I was right all along when I said the estimated savings figures published by successive governments and the Energy Saving Trust were (and still are to this day) completely misleading and inaccurate!

Fact: Energy efficiency estimated bill saving figures are wrong/misleading and by a long way!

Golden rules of shopping local.

By Value hunter on Dec 4, 2013 | In In real life, Money chat, Bad business, Frugal wars, Thrifty shopping, Rip off Britain | Send feedback »

This weekend, is "Small business Saturday" (Yes I hear you sigh, yet another sales/marketing gimmick assigned to the calendar, to increase the flow of money from our pockets, but I digress).

Shopping local is a great way to ensure that money spent also helps to boost the local economy, instead of lining a shareholder's or corporate business' pockets in some far away place.

However, it is vital that those on a budget, watch their pockets (as I'm sure we do anyway) and there are some golden rules I've come across in my years of cutting back supermarket influences on our home and budget.

Avoid butchers that are on the high street!

By this I mean there are those in villages and located on main roads that have considerably lower overheads than those on the high street.

I've also found these to be cheaper, by some distance.

When missing my main road butcher, I have tried others, on main shopping streets and the price/quality differences have been substantial.

My usual weekly order of meat comes to around £25. The same meat from a "Local" high street butcher was close to £40 for the same items.

I also get my cheese (made in the area) from the butchers, the price difference between my regular butcher and the high street butcher was over £6 for two blocks of cheese.

Look out for the staff numbers - in my regular butchers, they have two staff serving, one more cutting and one more cleaning.

At the high street rival they had four people serving, three cutting and two seperate staff for their "Deli counter" - wage bills are reflected in their prices I'm sure.

The meat quality is also a factor. The old addage applies - "Tough meat is old meat!"

My regular butcher pays less attention to his deli counter and serves a close knit community from a main road (running through the area) shop.

It is always busy, with good reason, their meat is always fresh. I cannot remember the last time I had tough meat from them, I incinerate lamb chops, they still come out tender.

Many businesses are trading on the back of being "Local" and "not supermarkets" but is essential their prices and quality are good value.

Buying fresh fruit and vegetables - simple one this, use your outside market!

Look out for market stall holders that supply businesses in the area. They have less storage space, less access to freezers, make use of wholesalers more often and have a faster turnover of stock. This keeps their produce fresh!

Those with shops have more room to freeze and chill stock, prolonging shelf life for their goods, shortening the value and shelf life for you the customer.

I cannot reiterate this enough, NEVER buy fruit and vegetables from a supermarket!

They can be anything up to a year old before you pick them from the shelf. They are chilled all the way along the process, they are chilled in storage, transportation and each and everyday they are kept in the supermarket.

One easy point to make, their prices are extortionate!

I pay 40p per kilogram for my King Edward potatoes (granted I buy them once a month by the sack)

Asda price is currently 90p per kilogram (works out at £22.50 per sack!)

Tesco price is currently 90p per kilogram (coincidence?)

Waitrose price starts from £1.25 a kilogram (works out at a staggering £31.25 per sack!)

It makes you wonder why they have foodbank collections in supermarkets when these are the prices they charge!

The quality is far better as well, not starting to turn for around 5 weeks.

High street prices from greengrocer shops are running at around 85p per kilogram.

Eggs:

As my local greencgrocer also supplies businesses, they also supply eggs!

A full TRAY (2 dozen) of medium/large eggs costs me £3

How much did you pay for your last half dozen? £1? £1.10? £1.20?

My outside stall market greengrocer has lower overheads, faster turn over of stock (fresher stock) and is way better on price than anything on the high street for deals.

Fresh fish:

A market can have a few fishmonger stalls on it.

Look for the small one man band outfit that does not have the biggest counter.

The fish I get, finney haddock, kippers, beautiful white cod, huge plaice fillets, all boned and ready to go, is reasonably priced and fresher than anything I've tasted in any supermarket/high street.

Once again, he has little storage space, he has a vast knowledge and experience of how to cook his wares and lower overheads, so cheaper prices.

I haven't found anyone offering the same service he does for anywhere near the same quality and price. It's a no brainer for me.

Farmer's markets:

Many people speak highly of these and in certain areas are a welcomed break in terms of quality of goods on offer.

But for me, they are a no-go area.

They pop up every couple of weeks or month, in my experience their prices are way above what should be charged, a premium!

Anyone can run a stall on them and often do.

While there are those whom do not have the choice that I have in my area, two small towns with markets within a couple of miles of each other, I can fully see why farmer's markets appeal.

Look out beyond the town centres, look at the places surrounding you, on the way there see if you notice a road side butchers, greengrocers or little market.

People make a living from travelling around up to 6 farmer's markets every month, the cost of stalls is often higher than a regular market, which has all to be made back in profit for them to break even.

This comes from the prices they charge YOU!

I use local small businesses every week of the year. Established quality and prices are extremely better value than any supermarket can provide, they have low overheads so this is factored into their prices.

Goods are very high quality and shelf life is long.

But be aware, there are some that are trading on regenerated high streets that are milking the "shop local business" bandwagon, it's YOU that could be paying for it!

New boiler energy saving myths, true or false?

By Value hunter on Oct 2, 2013 | In In real life, Common sense, In the home, Bad business, Frugal wars, What is the point?, Rip off Britain | Send feedback »

In my family's experience, replacing our old G rated boiler with a new A rated boiler to "save money" turned out to be false.

Our energy bills, in metered units used, increased, albeit by a small number.

Any so called "money saving" vanished when the price of the boiler and installation, we discovered later, would never be recovered. The new boiler would never pay for itself, over the boiler's lifetime.

You can read the original post here "New boiler energy saving myths exposed" (Scroll down for the comments)

A recent comment on there left by Jeff, was a tad harsh, labelling my post as "dangerously inaccurate" and "you don't understand your bill, how energy works, central heating systems, how companies work, or basic mathematics. You're comments are dangerously inaccurate, and you're doing a great disservice to anyone else who reads this and is as misinformed as you"

So should people be replacing or have replaced their old G rated boilers?

The Energy Saving Trust (EST) stated during the government funded warmfront campaign, savings of "up to £300"

Jeff posts "... EST's estimate of £300 savings, this is based the fact that the average UK gas heating bill is approximately £1000 per year"

Well Jeff (and others) it's all well and good saying this now, but nowhere on their website were these estimated figures being based upon the "average gas heating bill being approx £1000 per year" published at the time they were running the warmfront scheme, nor are they posted upon there now that I can see?

Today, there is no reference of this claim on their website. All that is posted is this...

"These are estimated figures based on installing a new A-rated condensing boiler and full set of heating controls in a gas-heated, semi-detached gas heated home with three bedrooms"

Today's version of the energy saving trust's website, showing how they reach their calculations can be seen here http://www.energysavingtrust.org.uk/Energy-Saving-Trust/Our-calculations (UPDATE: Their calculations page has been removed and now directs you to a contact web page)

The energy saving trust state, "The efficiencies shown are SEDBUK 2009 efficiencies, the current standard for boiler comparison."

But on SEDBUK's own website (Found here http://www.boilers.org.uk/pages/sap2009.htm) it states clearly, "...the results are not themselves a satisfactory guide to efficiency achieved under installed conditions. Neither can the results be used to compare one boiler with another, as different test conditions are applied according to boiler type and fuel used"

Just to remind you, the energy saving trust website states... "The efficiencies shown are SEDBUK 2009 efficiencies, the current standard for boiler comparison" SEDBUK's own website says their findings/results CANNOT be used for boiler comparison!

So who is being inaccurate Jeff?

Sounds like the energy saving trust to me Jeff....

There is nothing to support your statement of what the EST's calculations are based upon.

Is this not being dangerously inaccurate, as you say I am?

If your statement is true then where is it posted by the EST or SEDBUK?

Why isn't it widely published and easily accessible to people that are looking to cut their energy bills via their heating system?

Jeff claims that I do not know how central heating systems work.

I put it to Jeff (and others) that the energy saving trust do not know how central heating systems work.

While at the time and to a great extent today, consumer groups and the energy saving trust make vague claims of the benefits of A rated boilers over G rated back boilers, would be better, what not a single one of these so called "experts" have picked up on, is that the old back boilers (G rated or better) heat hot water at the same time as heating the home.

A simple grasp of reality shows that a home heating water using the same energy that also heats the home HAS to be more beneficial to the user.

Millions of back boilers were removed under the warmfront scheme that the energy saving trust ran for the government at the time, yet at no point in their annual reports, summaries, or findings is this shown to have been taken into account. Why not I wonder?

The energy saving trust go even further.

Since they stopped running the warmfront scheme for those in power and revamped their own website, they now advocate that "...A regular boiler is actually more efficient than a combi at producing hot water in the first place" Just for clarity, "a regular boiler" is most commonly a back boiler with a hot water tank - the very same type of central heating systems they were advocating removal of under the warmfront scheme!

Jeff continues... "As for your assertion that your maintenance plan eats into your savings, no one's making you purchase one of these. It's a choice as to whether or not you think you'll have the funds available if your boiler breaks down. And it's an entirely independent choice and has nothing to do with whether or not you have an old G- boiler or a new A- one. So get that out of your head."

Lifetime of new A rated boilers - according to the energy saving trust warmfront figures - shows they last around 12 years.

Are people to seriously not bother servicing their boilers? Or to pay out of their pocket each year to have it serviced?

Then there are repair costs on top of this.

Let's not forget, combi and condensing boilers have many more parts that can go wrong than a conventional back boiler.

A neighbour of mine has had to fork out over £80 three times in 4 years because of early winter boiler breakdowns of her trusty A rated new boiler.

Monthly maintenance contracts or repair costs as and when the boiler breaks down, it matters not, it will eat into any predicted "savings" to the owner.

I know it's an entirely independant choice and I never said it mattered that's it's an A rated or G rated boiler... some form of repair/maintenance costs have to be factored in to the "savings" as they are unavoidable.

Back to Jeff... "As for your BG friend who told you that new boilers use the same gas, but produce less CO2. Did that really make sense to you?"

As I explained, I have long since given up on being able to believe anything from the big 6.

Less emissions while using same gas is just one in a long line of claims from energy companies.

Not my BG friend, but a time served engineer whom tested meter, pipework and appliances in an official capacity.

The fact remains that with one less adult in the home, more energy saving measures fitted than any of the big 6 energy company's own "energy efficiency expert departments" could recommend, less appliances using the new boiler, my metered units used INCREASED.

... and finally, "A common mistake people who install energy efficiency measures make is to take advantage of the extra comfort those measures provide. In other words, a previously cold home had it's occupants wearing lots of clothes in the winter to stay warm. But once the new measures were put in place, they cranked up the heat and shed the extra layers. Well, sorry to say, that's going to have an impact on your energy usage"

Of course it is, but we heat our home without using any gas now, yet metered units used INCREASED.

We wear MORE warm clothing than when we had the old back boiler, we no longer have a gas fire, we have one less adult in the home.

I'll leave you with a twitter reply from none other than British Gas.

They asked what their customers would like to see in the future, I replied, "Energy saving measures being fitted and bills FALLING"

Here's what they said, https://twitter.com/Frugal_ways/status/362562467093676033 "Energy efficiency will reduce the cost of future bill increases" - they will not cut or save you money off your energy bills.

Many many people are finding that fitting a new boiler does not cut their bills, worse still, at the same time a new boiler cost is never recovered over the lifetime of the boiler in "estimated bill savings" - in our case, believing all the hype has cost us in the pocket.

If the cost of buying, fitting and running a new boiler is not recovered in REAL cuts to energy bills (Not even under "estimated" figures is this the case) then that leaves the individual OUT OF POCKET!

Simple mathematics!

Has this happened to anyone else?

A day in Lytham St Annes

By Value hunter on Jul 14, 2013 | In In real life, Mystery shopper | Send feedback »

Driving into St Annes for an afternoon to check out an alternative to Blackpool, we didn't know what to expect.

Trying to avoid the over £7 parking charges of Blackpool, all I was hoping for was a decent chippy, some ice cream and a beach.

Driving through the main shopping street was easy enough for us as first time visitors, right on to the prom, we managed to bag a parking space no problem at all.

£4.30 for all day parking within a stones throw from the beach was a great start.

At last, we thought, a council using it's common sense to attract visitors.

Varied shops, including a Bon Marche (thought they had gone bust?) and a few charity shops, with banks within walking distance from the sea front.

An open air kiddies pool just off the beach, another plus.

Not too many kiosks to choose from, just enough to offer some choice.

A mini toddlers fair was yards from the beach, along the sea front. Another plus.

Those big balls that you can run around in and some small boats to take out on a small cove of water seperate from the sea was more good stuff to see.

Food... Not too many chippies to pick from but we went for the chippy just off the main shopping street.

Tables outside were littered with cigarette stubs on the floor, no probs we'll eat take-out.

The award for the most staff ever seen in a chip shop goes to... still they were all very friendly and chatty, good service.

Where it fell down was the price.

£9.50 for two lots of fish and chips!

Fish were a regular size and chips were a small portion, but they were decent enough.

We decided to eat them on the beach. The sandy beach, near to the small pier, had lots of litter (it was teatime though) and broken shells, some quite sharp. Tide was out.

Barbeques were going nearby on the sand, good to see in my view. There were donkey rides available. The volleyball net was a nice touch, although whether this is a council thing or someone's own I couldn't make out.

We scoffed the fish and chips and made our way to the main seafront to grab an ice cream. Bins were full and rubbish piled up alongside them, where we placed our tied up bag of fish and chip wrappers, but we did spot a council worker emptying bins further down the front, a thankless task on a hot day.

We stopped at a brick kiosk for a Mr Whippys ice cream. Double 99, single 99 in a chocolate cone and a single cone 99 for the sprog set us back a shocking £8.50!

(The same items from our local ice cream van would cost £4.60)

Clearly their ice cream needs more cream and less milk, as within 5 minutes all had completely melted, even the adult ones could not be eaten quickly enough.

We noticed that the beach further down the coastline away from the pier cove, was alot cleaner and better quality. If we return we will park further down.

So to sum up;

Parking: Easy, plenty of spaces and a lot cheaper than Blackpool. 9/10

Attractions: Good variety, more for the younger ones. 8/10

Town: The main street we walked around, just off the seafront, decent variety and easy to find banks, interesting buildings and a few pubs. A good mix. 8/10

Food: Fish and chips - decent quality, but over priced. Ice creams - poor quality and over priced. 4/10

Beach: Too much litter (but it was late in the day) 4/10

Better to aim further up the coast for better quality beach.

I don't understand how a fish bought in a coastal town can be around a pound more expensive than a fish bought 20 miles inland and needs to be delivered?

If you fancy a day out, there are a lot worse places to visit than St Annes, good variety, plenty going on, but take a packed lunch/some fruit if you are on a budget.